IR BLOG

Results for 2022 – Q&A

The year 2022 ended with a solid quarter, driven by our Nordic P&C operations.

Sampo Group’s profit before taxes for 2022 amounted to EUR 1,863 million (3,171). Excluding accounting effects defined as extraordinary items in accordance with Sampo Group’s dividend policy, the profit before taxes decreased to EUR 1,725 million (2,189), mainly as a result of Nordea no longer being consolidated as an associate. In Q4, profit before taxes amounted to EUR 390 million (1,197) or EUR 355 million (452) excluding extraordinary items.

Earnings per share for 2022 amounted to EUR 2.69 (4.63) or EUR 2.41 (2.86) excluding extraordinary items. In Q4, earning per share was EUR 0.50 (1.89) or EUR 0.41 (0.55) excluding extraordinary items.

Sampo Group’s core business, P&C insurance reported an underwriting profit of EUR 1,314 (1,282) for 2022 and EUR 304 million (297) in Q4. The Group combined ratio stood strong at 82.1 per cent (81.4) for 2022 and 83.7 per cent (83.0) in Q4.

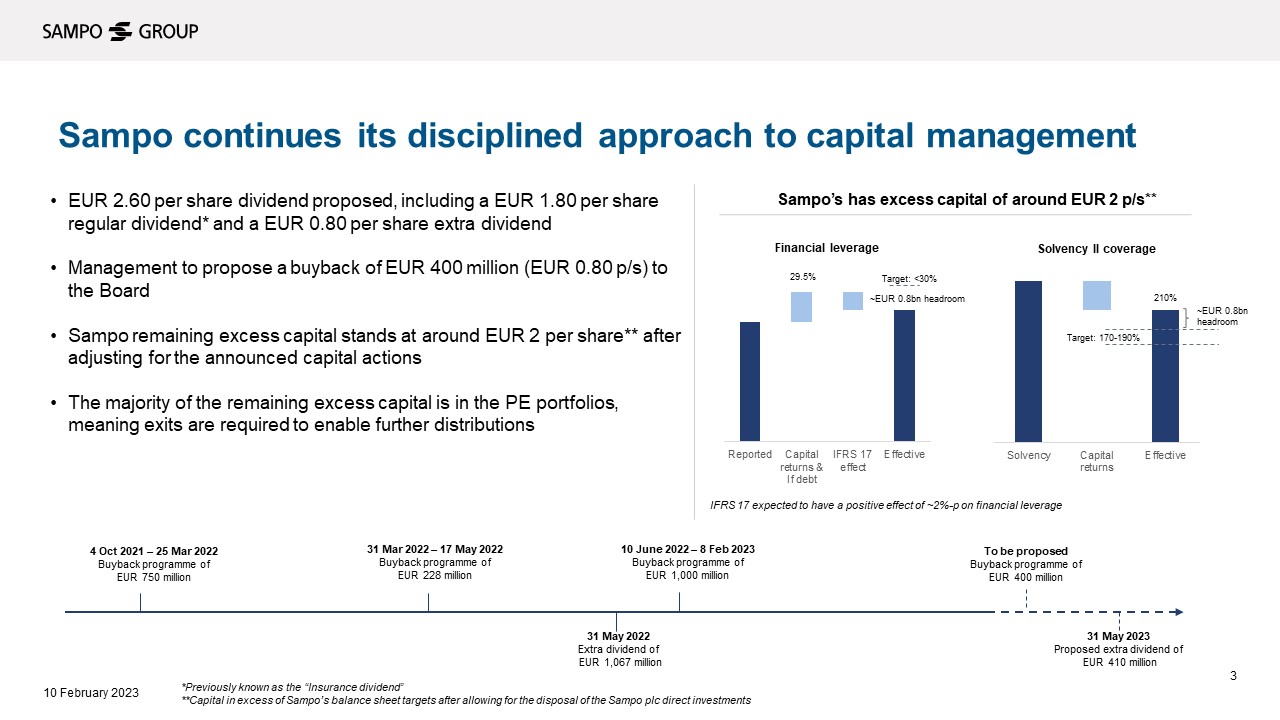

Sampo plc’s Board of Directors proposes a dividend of EUR 2.60 per share for the 2022 financial year to the Annual General Meeting to be held on 17 May 2023. This consists of a regular dividend (formerly known as the insurance dividend as introduced at the 2021 CMD) of EUR 1.80 per share (1.70), representing growth of 6 per cent, and an extra dividend of EUR 0.80 per share. In addition to the dividend, management is to propose to the Board a new EUR 400 million buyback programme.

| Key figures, EURm | 2022 | 2021 | Change, % |

10-12/2022 | 10-12/2021 | Change, % |

|---|---|---|---|---|---|---|

| Profit before taxes | 1,863 | 3,171 | -41 | 390 | 1,197 | -67 |

| If | 1,217 | 1,077 | 13 | 285 | 260 | 10 |

| Topdanmark | 220 | 346 | -36 | 128 | 89 | 44 |

| Hastings | 73 | 127 | -43 | 7 | 11 | -34 |

| Mandatum *) | 207 | 291 | -29 | 18 | 91 | -80 |

| Holding *) | 146 | 1,331 | -89 | -48 | 746 | - |

| Profit for the period | 1,541 | 2,748 | -44 | 323 | 1,086 | -70 |

| Underwriting profit | 1,314 | 1,282 | 2 | 304 | 297 | 2 |

| Key figures | 2022 | 2021 | Change | 10-12/2022 | 10-12/2021 | Change |

| Earnings per share, EUR | 2.69 | 4.63 | -1.94 | 0.50 | 1.89 | -1.39 |

| EPS (without eo. items), EUR **) | 2.41 | 2.86 | -0.45 | 0.41 | 0.55 | -0.14 |

| EPS (including OCI), EUR ***) | -0.26 | 5.90 | -6.16 | 0.71 | 2.22 | 1.63 |

| RoE (including OCI), % | -1.3 | 26.8 | -28.1 | - | - | - |

*) After Mandatum’s group contribution of EUR 29 million in Q4/2022 and EUR 15 million in Q4/2021 to Sampo plc.

**) The accounting effects treated as extraordinary items in accordance with Sampo Group’s dividend policy amounted to EUR

138 million in 2022 and EUR 35 million in Q4/2022. In the comparison period, extraordinary items were EUR 982 million in 2021

and EUR 746 million in Q4/2021.

***) OCI refers to Other comprehensive income.

The figures in this report have not been audited.

How did the claims inflation develop in Sampo’s core markets?

In the Nordics, the claims inflation was at 4-5 per cent in Q4, broadly unchanged from Q3. By business area, in Commercial and Industrial the claims inflation was in the upper end of the range, in Private in the lower end.

If increased prices by 5-6 per cent in Q4, with continued high retention and good new business flows.

In the UK, the market wide motor claims inflation remained high at 12 per cent, also broadly unchanged from Q3. Market prices have been increasing but still lagged claims inflation. Hastings has remained disciplined in its pricing.

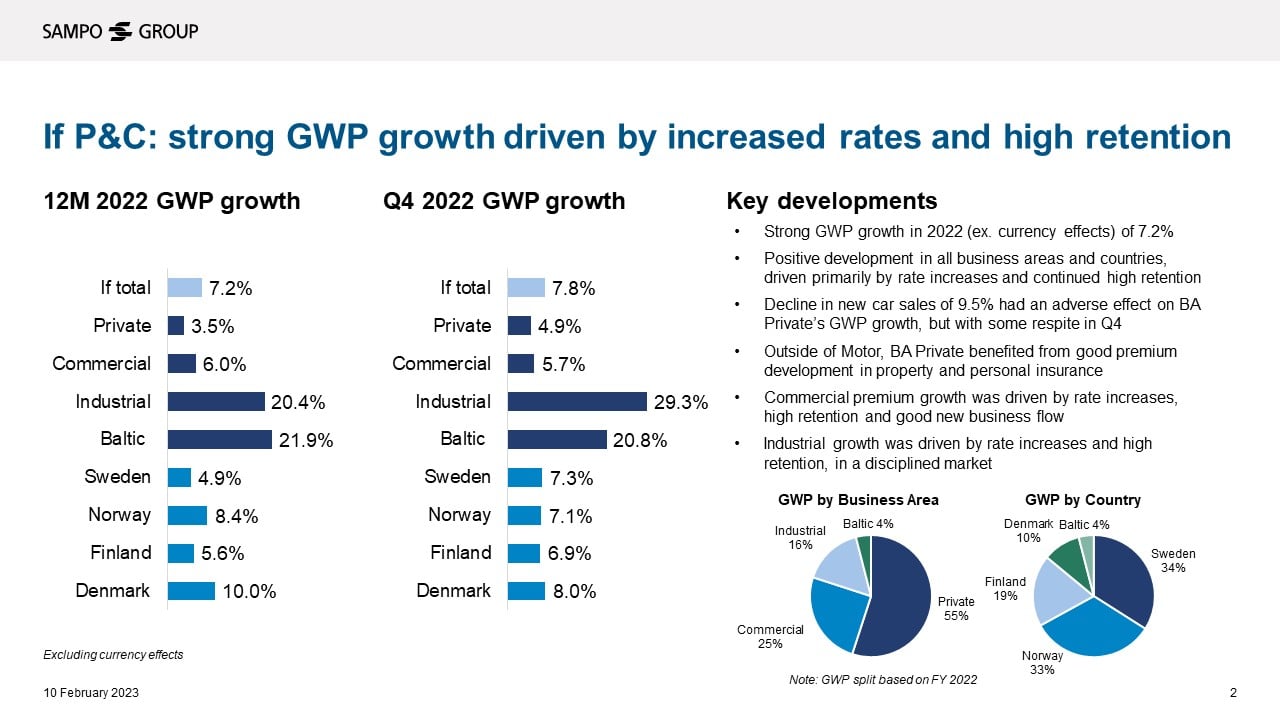

If’s currency adjusted gross written premiums (GWP) growth accelerated from 5.7 per cent in Q3 to 7.8 per cent in Q4. What were the key drivers behind this growth?

The GWP growth was robust across the board and driven primarily by rate increases, strong customer retention and an increase in customer count year-on-year. The strongest growth was achieved in business areas Industrial (29.3%) and Baltic (20.8%).

If’s largest business area, Private, delivered GWP growth of 4.9 per cent, supported by a rebound in travel insurance volumes, healthy growth in Property and Personal and a recovery in new car sales attributable to Norway and Sweden.

Hastings reported solid topline growth, but the operating ratio deteriorated to 94.0 per cent in Q4 from 87.9 per cent a year ago. What drove the increase in the operating ratio?

Due to seasonality in weather conditions, Q1 and Q4 are typically more challenging than Q2 and Q3. However, in Q4/2022 the UK experienced harsher winter conditions compared to Q4/2021, leading to an increase in claims frequencies. This, combined with the elevated claims inflation, pushed Hastings’ operating ratio higher.

Given the challenging environment throughout the year, Hastings’ full-year operating ratio of 89.7 per cent was resilient, although above the target of 88 per cent.

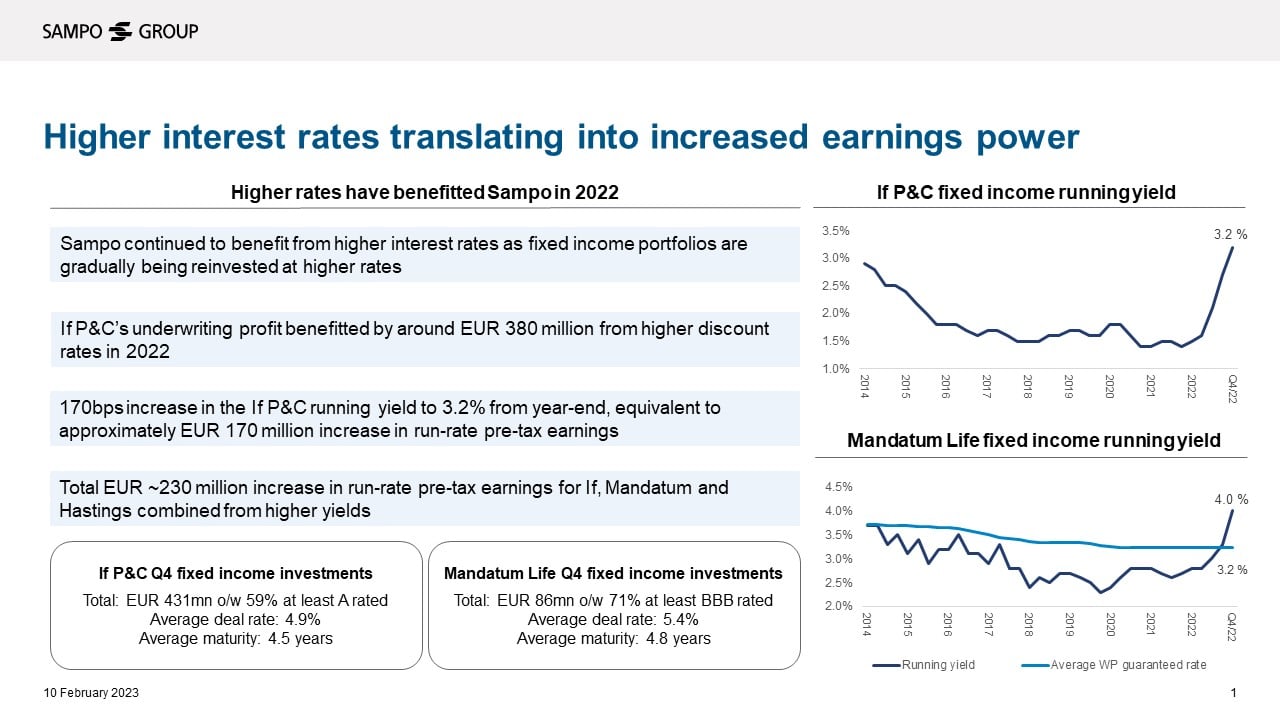

Interest rates continued to rise in Q4. How did this affect Sampo’s investments?

Due to our short duration of our fixed income portfolios, we were able to continue to rapidly reinvest our proceeds and benefit from higher interest rates.

If’s running yield amounted to 3.2 per cent at the end of 2022, up from 1.5 per cent at the end of 2021 and 2.7 per cent at the end of Q3. Meanwhile, Mandatum’s running yield increased from 3.3 per cent at the end of Q3 to 4.0 per cent at the end of 2022, the highest since Q3/2013.

Over 2022, higher running yields have added roughly EUR 230 million to Sampo’s annual pre-tax earnings power.

If’s discount rate in Finland increased by 0.25 percentage points in Q2 and Q3 but by 1.25 percentage points in Q4. What was the rationale behind the big increase in Q4?

The Finnish discount rate increased from 1.25 per cent to 2.50 per cent to bring it closely into line with the market interest rates. Due to the implementation of IFRS 17 on 1 January 2023, all discount rates are based on market rates from 2023 and onwards. Thus, the increase was in line with the new discounting method.

The total positive profit effect of increases in discount rates, including the Finnish discount rate, was EUR 218 million in Q4. This was partly offset by an increase in the claims reserve of EUR 123 million consistent with If’s prudent reserving approach.

Due to the big increase in the Finnish discount rate and the increase in claims reserve, some of the key ratios on a Business Area and country level may not be representative of the underlying level of profitability within these. For example, the reported combined ratio in Finland was 8.5 per cent in Q4.

Sampo made some adjustments to its dividend policy for 2023 and onwards. Why, and will this affect the dividend trajectory?

The adjustments in dividend policy are not expected to have any significant effect on the size and trajectory of dividends.

According to the updated dividend policy, Sampo is to pay a stable and sustainable regular dividend (formerly known as the insurance dividend) that grows in line with the Group’s earnings over time. Total annual dividends paid will be at least 70 per cent of Group’s operational result.

The main adjustment relates to the calculation of the payout ratio. The implementation of IFRS 17 and 9 on 1 January 2023 will bring asset and liability side mark-to-market effects into Sampo’s reported net income. In other words, the reported profit may become more volatile. Thus, it makes more sense to use the new operational result as the base of the payout ratio calculation rather than the reported net income affected by volatile items.

The full definition of the operational can be found at www.sampo.com/dividend.

How much excess capital does Sampo now hold?

In addition to the regular dividend of EUR 1.80 per share, the Board of Directors of Sampo propose an extra dividend of EUR 0.80 per share. Also, the management intends to propose a new buyback programme of EUR 400 million, corresponding to around EUR 0.80 per share.

Allowing the EUR 0.80 + 0.80 per share excess capital returns, Sampo’s remaining excess capital stands at around EUR 2 per share, of which majority is tied in the “PE portfolio”.

Why was the strategic review on Mandatum not concluded yet?

The Board wants to do a thorough job of investigating all the available opportunities. This is a process that takes some time. Sampo expects to provide an update on the process by the end of Q1.

Could you split up Mandatum and sell or list it in parts?

No, a break-up of Mandatum is not being considered. This would not work economically due to the high degree of operational overlap between the different departments.

A partial demerger is one option the Board is considering. What would this mean and what would the process be?

In a partial demerger, Mandatum shares would be spun out of Sampo and issued to existing Sampo shareholders. Mandatum would then continue as an independent company with its shares listed in Helsinki Stock Exchange.

The listing of Mandatum would be technical, and no cash proceeds would be generated by Sampo or Mandatum.

If the Board decided to propose a partial demerger to the Annual General Meeting, the proposal would require a 2/3 of shareholders votes. Schedule-wise, the potential partial demerger could be delivered during the second half of 2023.

Pictures: Investor Presentation 2022internal link