IR BLOG

Results for 2023 – Q&A

Sampo Group delivered strong premium growth and resilient underwriting margins in 2023, despite the year being characterised by elevated severe weather and large claims experience, as well as unfavourable currency movements.

Profit before taxes from P&C operations increased to EUR 1,481 million for 2023 after adjusting for IFRS 9 (803). Earnings per share amounted to EUR 2.62 (3.97), of which EUR 2.12 (2.88) was from continuing operations.

In Q4, profit before taxes from P&C operations increased to EUR 368 million after adjusting for IFRS 9 (67). Earnings per share amounted to EUR 0.76 (0.14), of which EUR 0.54 (0.07) was from continuing operations.

Sampo’s Board proposes a dividend of EUR 1.80 per share for 2023, representing a payout ratio of 86 per cent based on the operational result of EUR 2.07 per share. The proposed total dividend consists of a regular dividend of EUR 1.60 per share and an extra dividend of EUR 0.20 per share. The proposed regular dividend represents growth of 7 per cent from the prior year regular dividend of EUR 1.50 per share adjusted for the partial demerger.

Sampo will issue an outlook statement for 2024 in connection with the publication of its 2024-2026 financial targets at its Capital Markets Day on 6 March 2024.

| Key figures, EURm | 1-12/ 2023 |

1-12/ 2022 |

Change, % |

10-12/ 2023 |

10-12/ 2022 |

Change, % |

| Profit before taxes (P&C Operations) | 1,481 | 1,924 | -23 | 368 | 67 | 449 |

| If | 1,358 | 1,550 | -12 | 369 | 60 | 520 |

| Topdanmark | 162 | 158 | 3 | 19 | 79 | -77 |

| Hastings | 129 | 107 | 21 | 59 | 6 | 866 |

| Holding | -160 | 146 | — | -78 | -48 | 64 |

| Net profit for the equity holders | 1,323 | 2,107 | -37 | 382 | 61 | 526 |

| Underwriting result | 1,164 | 1,031 | 13 | 281 | 109 | 159 |

| Change | Change | |||||

| Earnings per share (EUR) | 2.62 | 3.97 | -1.36 | 0.76 | 0.14 | 0.62 |

| Operational result per share (EUR) | 2.07 | — | — | 0.42 | — | — |

| Return on equity, % | 15.6 | 4.2 | 11.4 | — | — | — |

| Profit before taxes (adjusted for IFRS 9), EURm * | 1,481 | 803 | 84% | 368 | 176 | 110% |

The comparison figures for 2022 have been restated for IFRS 17 but not for IFRS 9, meaning some figures, such as investment income, are not presented on a comparable basis between the reporting periods. Net profit for the equity holders, EPS and return on equity figures include results from life operations. Mandatum was classified as discontinued operations as of 31 March 2023.

*) To enhance comparability, a Group profit before taxes (P&C operations) figure adjusted for IFRS 9, reflecting market value movements, has been provided for the prior year.

The figures in this report have not been audited.

The Group top line growth amounted to 12 per cent on a currency adjusted basis in Q4. What were the main growth drivers?

The top line growth in Q4 was supported by continued solid development in the Nordics and strong pricing trends in the UK.

In the Nordics, our largest business area Private saw currency adjusted growth of 5.0 per cent. This was driven by continued strong momentum in non-motor lines, particularly in personal insurance. Meanwhile, growth in motor insurance continued to be affected by weak, albeit stable Nordic new car sales. Commercial had a strong quarter with growth accelerating to 6.7 per cent, while Industrial saw 3.5 per cent growth.

In the UK, the pricing environment continued to improve in Q4, albeit at a slower pace, which enabled continued price increases and volume growth for Hastings. Hastings’ gross written premiums increased by 34 per cent on a local currency basis.

What kind of claims experience Sampo had in Q4?

The claims experience in Q4 was challenging due to elevated severe weather conditions in the Nordics. The beginning of the quarter was stormy particularly in Denmark. This was followed by an early winter with heavy snowfall and freezing temperatures.

Despite of the adverse claims experience, Sampo reported robust underwriting profit of EUR 281 million (109) and a combined ratio of 85.5 per cent (94.5), thanks to our diversification and disciplined underwriting. Please note that, these figures are not fully comparable between years, as explained below.

Excluding volatile and technical items, the underlying margin development remained positive in the Nordics in Q4, as If’s undiscounted adjusted risk ratio improved by 0.5 percentage points year-on-year.

How did the claims inflation develop in Sampo’s core markets?

In the Nordics, claims inflation has stabilised and was at the lower end of the 4-5 per cent range observed over 2023. In property insurance, claims inflation has clearly slowed down as material prices have come down. In motor insurance, claims inflation has stabilised at a relatively high level, partly on currency pressure.

In the UK, motor claims inflation was around 12 per cent for most of the year 2023, but Q4 saw a modest reduction.

Have you seen any trend changes in claims frequencies?

Frequency trends vary by geography. For example, there has been some increase in frequencies in Norway. However, the overall development has been in line with our expectations. This illustrates the benefit of having well diversified, pan-Nordic operations.

How would you comment the 1 January renewals for commercial lines?

We had a positive outcome with high acceptance rates despite high-single digit price increases across the book to secure inflation expectations and underlying claims trends. We also reduced exposure to some higher risk segments such as single large properties.

The beginning of the year is important for our corporate lines, as over 40 per cent of If’s Commercial and Industrial portfolios are being renewed on 1 January.

Sampo reported strong investment returns in Q4 and 2023. What were the key drivers behind this performance?

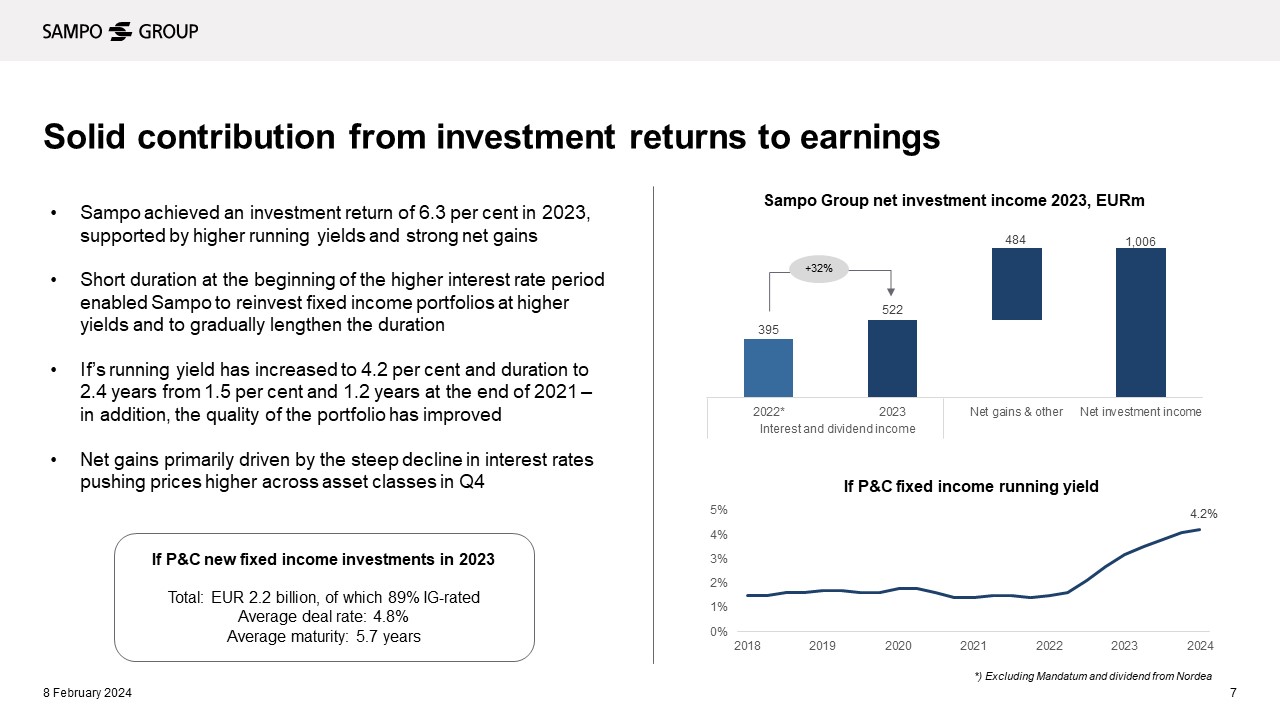

We continued to benefit from higher interest rates as our short duration has allowed us to reinvest into higher yielding instruments. In 2023, If’s new fixed income investments amounted to EUR 2.2 billion and the average deal rate was 4.8 per cent. In addition, the quality of the portfolio has improved as the environment has enabled investing into higher-rated instruments with good yields.

Driven by higher yields, the group dividend and interest income increased by 32 per cent in 2023. In addition, the net investment income was supported by strong net gains as the steep decline in interest rates pushed prices higher across asset classes in Q4.

Why were the group underwriting profit and combined ratio not fully comparable between 2023 and 2022?

Short explanation: because of the differences between IFRS 17 and IFRS 4.

Long explanation:

Under the old IFRS 4 accounting standard, effects from changes in discount rates went fully through the underwriting profit as prior year development (PYD). In Q4/2022 and under IFRS 4, increases in discount rates had a positive effect of EUR 218 million on If’s underwriting profit, primarily driven by the increase in the Finnish discount rate. However, this was partly offset by an increase in claims reserve of EUR 123 million, consistent with If’s prudent reserving approach.

Under the IFRS 17 accounting standard, effects from changes in discount rates go through Insurance finance income or expense (IFIE). As the 2022 figures were restated for IFRS 17, the positive effect that was booked in underwriting profit under IFRS 4, was now allocated to IFIE, but the negative effect from the increase in claims reserve remained intact. This is seen in PYD, which had a negative effect of 9.3 percentage points in If’s Q4/2022 combined ratio restated for IFRS 17, whereas under IFRS 4 the effect was 8.3 percentage points positive.