IR BLOG

Results for January-September 2020 – Q&A

Sampo Group’s profit before taxes for January-September 2020 amounted to EUR 1,054 million (1 073) and earnings per share was EUR 1.51 (1.38).

Results were driven by If’s very strong performance in the third quarter. In addition, investment income was supported by the continued positive development in the capital markets. Meanwhile, associated company Nordea showed more solid signs of progress towards its financial targets for 2022.

With the strong development in the P&C insurance operations, outlook for If’s combined ratio for 2020 was improved to 82-84 per cent from the previous 82-85 per cent.

| Key figures, EURm | 1-9/ 2020 |

1-9/ 2019 |

Change, % |

7-9/ 2020 |

7-9/ 2019 |

Change, % |

|---|---|---|---|---|---|---|

| Profit before taxes | 1,054 | 1,073 | -2 | 485 | 92 | 425 |

| If | 616 | 655 | -6 | 233 | 215 | 8 |

| Topdanmark | 85 | 180 | -53 | 46 | 34 | 35 |

| Associates* | 308 | 0 | - | 170 | -227 | - |

| Mandatum | 100 | 212 | -53 | 60 | 75 | -20 |

| Holding (excl. associates) | -53 | 26 | - | -25 | -6 | -333 |

| Profit for the period | 881 | 848 | 4 | 412 | 22 | 1,777 |

| Key figures | 1-9/ 2020 |

1-9/ 2019 |

Change | 7-9/ 2020 |

7-9/ 2019 |

Change |

| Earnings per share, EUR | 1.51 | 1.38 | 0.13 | 0.70 | 0.01 | 0.69 |

| EPS (based on OCI), EUR | 1.12 | 1.44 | -0.32 | 1.10 | -0.24 | 1.34 |

| NAV per share, EUR** | 18.63 | 20.71 | -2.08 | - | - | - |

| Average number of staff, FTE | 10,309 | 9,769 | 540 | - | - | - |

| Group solvency ratio, %** | 214 | 167 | 47 | - | - | - |

| RoE, % | 7.0 | 9.2 | -2.2 | - | - | - |

* The valuation loss of EUR -155 million on distribution of Nordea shares in Q3/2019 is included in the comparison figures.

** Comparison figure from 31 December 2019

The figures are not audited. Income statement items are compared on a year-on-year basis and comparison figures for balance sheet items are from 31 December 2019 unless otherwise stated.

How did the coronavirus pandemic affect Sampo’s business in the third quarter?

Sampo’s subsidiaries have been able to continue their operations normally despite the challenging environment. At the end of September, around 70 per cent of If’s and Mandatum Life’s personnel worked from home and recommendations for remote work continue.

In the short-term, the P&C insurance businesses have been positively affected by the coronavirus pandemic as claims have decreased due to slower economic activity and, in particular, lower traffic. During the third quarter, claims frequency returned to somewhat more normalized level as restrictions were eased, however with some variation between countries and business lines. The effect of the coronavirus pandemic on If’s risk ratio was approximately 3 percentage points positive in the third quarter.

Since last spring market turmoil, the coronavirus pandemic has not had a significant impact on Mandatum Life’s daily business.

If’s combined ratio was 82.9 per cent in the third quarter but 80.5 per cent in the second quarter. Why did the combined ratio deteriorate from the second quarter?

If’s combined ratio was negatively affected by the reduction of the discount rate used to discount the annuity reserves in Finland from 0.95 per cent to 0.75 per cent.

Long-term pension liabilities are discounted to present value. Such liabilities are common especially in workers compensation insurance and motor insurance. Discounting must be carried out in a safe manner. In addition, the returns of long-term high-quality bonds or government bonds must be taken into account when deciding the discount rate.

The lower the discount rate, the greater the present value of technical provisions is. Thus, lowering the discount rate will increase claims. The reduction of the discount rate used in Finland had a negative impact of EUR 51 million on the profit. Excluding this effect, If’s combined ratio was 80.9 per cent in January-September and 78.3 per cent in the third quarter. Even including the negative effect, If reported its best-ever third quarter combined ratio.

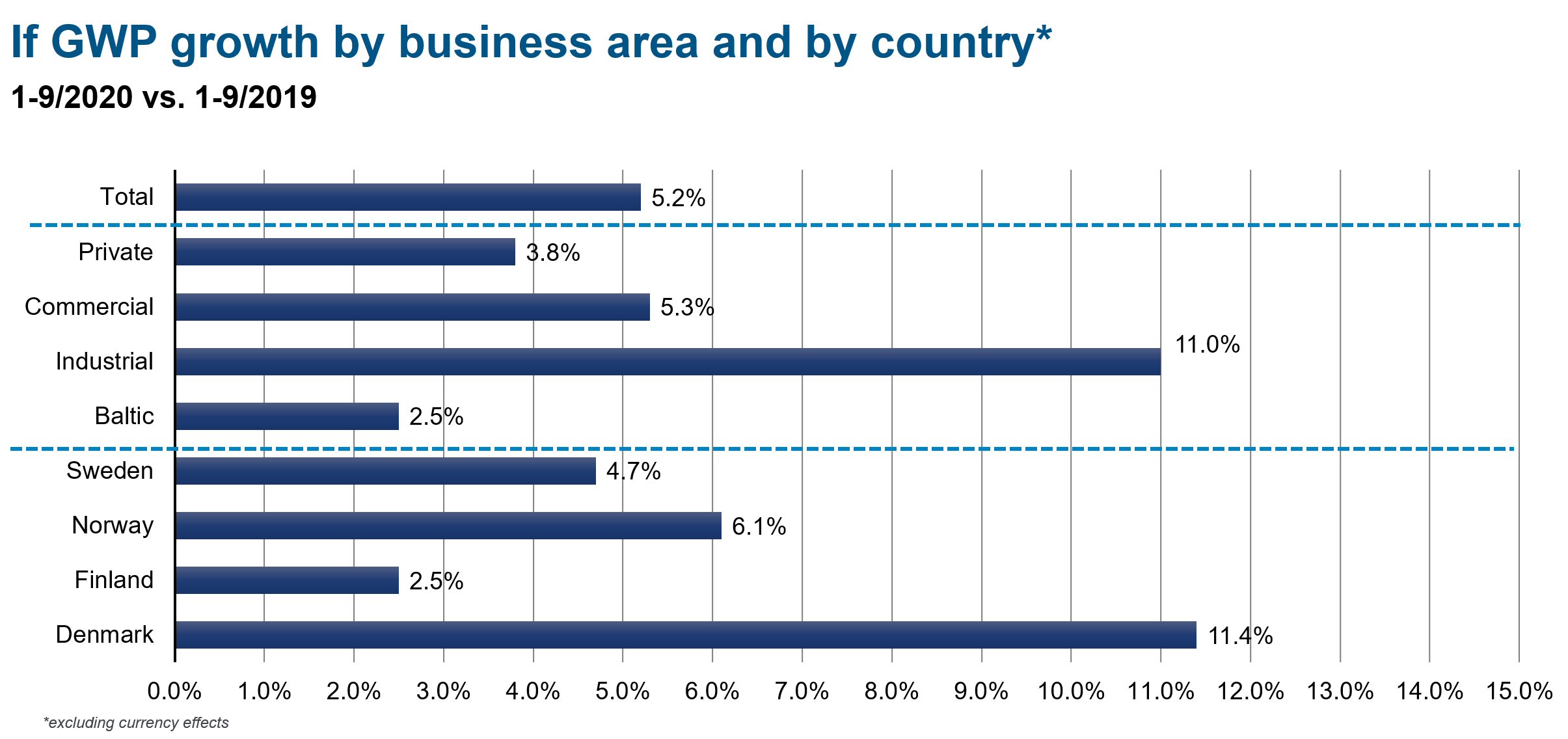

If’s premium growth was 5.2 per cent for January-September in local currencies. What were the growth drivers?

If reported a solid, organic premium growth in all Business Areas and markets with continued increase in number of customers and a stable retention throughout all segments. The growth has been supported by If being well positioned in the continued digitalization during these exceptional times.

The premium growth was strongest within corporate customers (BA Industrial 11.0% and BA Commercial 5.3%). In addition, the growth in If’s largest segment, BA Private, was very solid and accelerated in the third quarter compared to the second quarter.

Picture from January-September Supplementary Financial Information package.

Why did Topdanmark’s technical result decreased clearly in the third quarter compared to last year?

Topdanmark’s technical result was affected, among other reasons, by increased claims in house insurance, which had a negative impact of 2.1 percentage points on claims trend. Among the reasons are a higher level of water claims due to the rainy start of the year, COVID-19 has caused a higher level of refurbishment on houses increasing the number of water pipe and fungus claims and a couple of very large fire claims.

It is good to note that unlike If, Topdanmark operates only in Denmark. Thus, the volatility in claims frequency can be higher compared to a company that operates in multiple markets.

Further information on Topdanmark and its January–September 2020 Interim Report is available at www.topdanmark.com.

Mandatum Life’s technical with-profit portfolio related to higher guarantees (3.5% and 4.5%) dropped below EUR 2 billion for the first time. Why is this noteworthy?

Mandatum Life’s old with-profit portfolio has been in a run-off stage, because it ties a lot of capital and the company’s focus area is in wealth management and unit-linked products. In 2010, technical reserves of 3.5 and 4.5 per cent guarantees were over EUR 4 billion, and that figure is now halved. The decrease of with-profit portfolio improves Mandatum Life’s ability to pay dividend and releases capital to be re-allocated into more attractive assets.

The unit-linked portfolio, i.e. Mandatum Life’s focus area, continued its positive development and increased close to all-time high figure of EUR 8.1 billion at the end of September. Since the end of March, unit-linked reserves have increased by EUR 850 million.

Mandatum Life’s premiums decreased clearly in the third quarter compared to last year. What explains the drop?

The large difference is explained by the strong comparison period. 2019 was a record year for Mandatum Life’s unit-linked premiums. In addition, in the third quarter of 2019, premium income was driven mainly by couple of large contracts with corporate clients. Despite the coronavirus pandemic, Mandatum Life’s unit-linked premiums in January-September were at the same level as in 2018, which is the second-best year so far.

If decided to pay a dividend of approximately EUR 600 million, in December. What is the situation of Sampo’s other internal dividends?

Mandatum Life usually pays its dividend in the first quarter and the Board’s proposal is usually announced in the full-year financial statement. Mandatum’s dividend capacity is strong.

Both Nordea and Topdanmark has expressed their desire to distribute the undistributed dividends for 2019 but they will follow authorities’ regulations and recommendations.

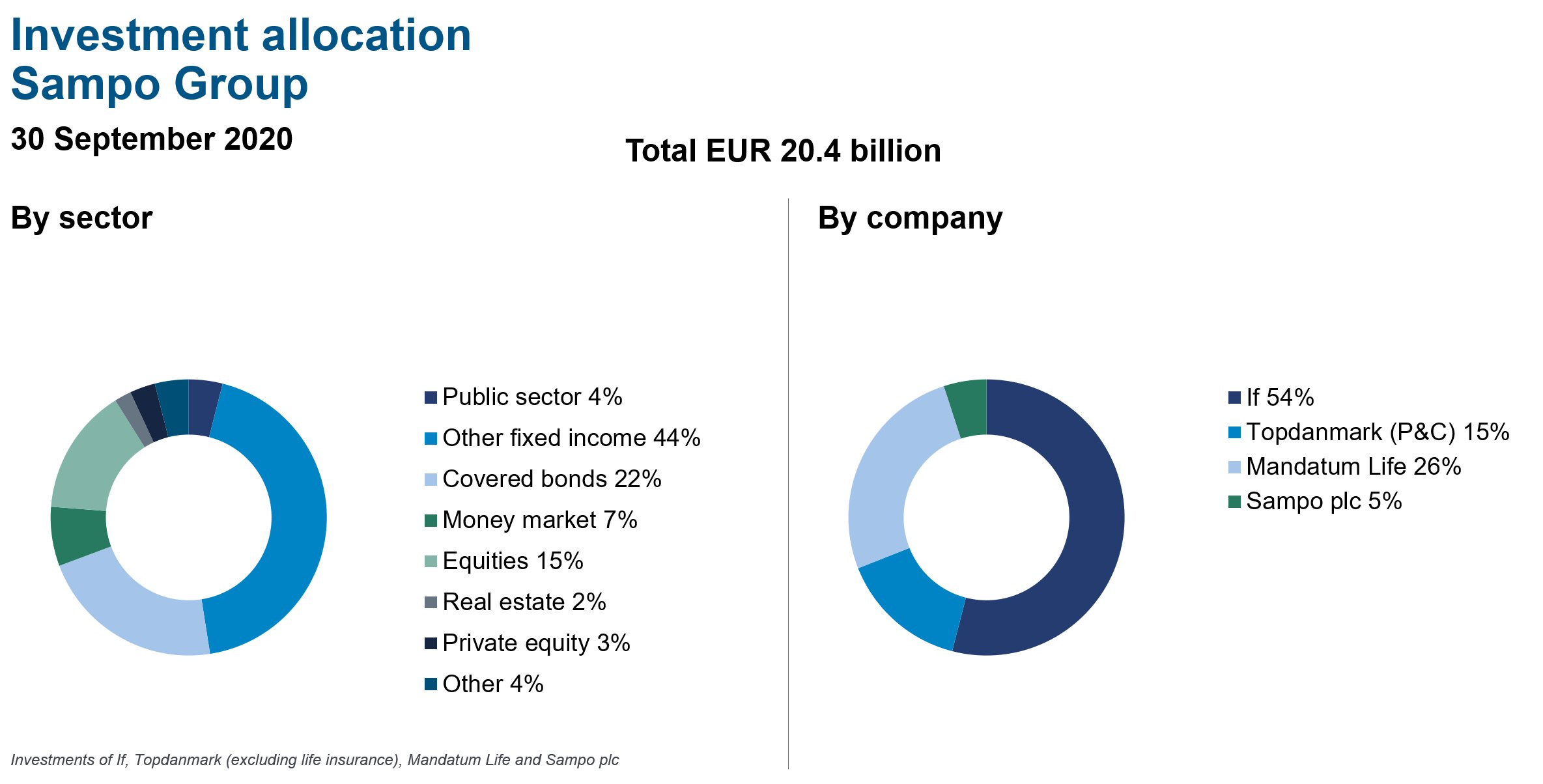

How did Sampo’s investments develop in the third quarter?

The continued positive development in the capital markets increased investment income in the third quarter. If’s net investment income was EUR 46 million (38) and Mandatum Life’s net investment income, excluding income from unit-linked investments, was EUR 53 million (77) in the third quarter.

There were no major changes in the Group’s investment allocation during the third quarter.

Picture from January-September Supplementary Financial Information package.

What is the situation of Sampo’s Hastings deal?

In September, Hastings’ shareholders accepted the offer made by Sampo and RMI as expected. At the end of October, Sampo announced that it has received all the regulatory approvals for the transaction. The next step is the Court Hearing procedure, which is anticipated to be held on 13 November 2020, after which the deal will be closed. Sampo will announce the completion of the transaction and the consolidation of the figures later.